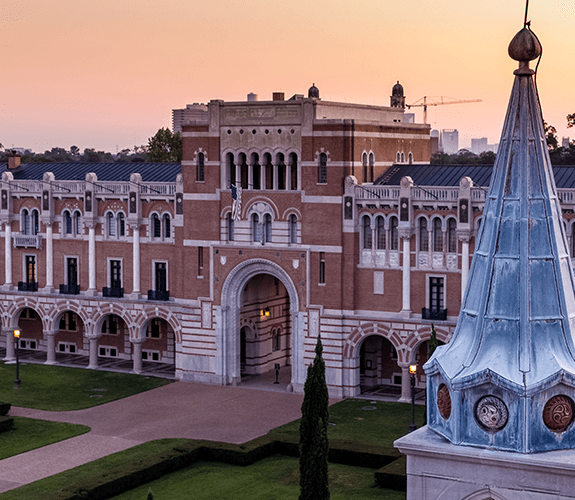

A Conversation with Kathy Collins and Allison Thacker ’96 on the Enduring Impact of Scholarship Endowments

Kathy Collins

Allison Thacker ’96

What does The Rice Investment mean to you personally and how does it reflect your own values and connection to Rice’s mission?

Allison: I met my husband Troy at Rice — we’re both from middle income backgrounds and went to public schools. For both of our families, affordability was the central part of why we were able to go to Rice and get such a great education. One of the concerns I always hear from families is that there's a lot of complexity around financial aid. They are not sure whether they can afford to send their kids to college. So I deeply love the fact that The Rice Investment makes financial aid so simple and transparent. Troy and I have established a scholarship for middle income students because we wanted to give back.

Kathy: I was so pleased that my team was able to assist in developing The Rice Investment. I think that a simple and generous financial aid message is so important to students and families that are considering Rice. The Rice Investment is vitally connected to Rice's DNA and to the goals of the Vision for the Second Century, Second Decade, especially our goal to increase access and affordability. From a personal standpoint, while I did not attend Rice, my husband and I have established a scholarship at the university because we think access and affordability is essential for students now and in the future. As vice president for finance, I know very well, how additional endowed scholarships add to the resources of Rice and help the budget support Rice’s mission.

You both have extensive experience with the endowment and university financial operations. What is one of the most common questions you hear today about the university’s endowment and/or financial aid?

Allison: The rising cost of education is a growing concern in the U.S., yet there are a number of misunderstandings around it. The main question for many universities like Rice is how are we utilizing our endowment funds? And are we spending enough of the endowment to fulfill Rice’s commitment to meet the full needs of those who receive financial aid?

Kathy: One misconception about the endowment lies in the difference between restricted and unrestricted funds. Approximately half of the endowment is unrestricted, and the rest is designated by donors for very specific purposes. We can't take endowments given for library books and spend them on scholarships, for example.

Allison: Certainly, the core obligation for both Kathy and me and the board of trustees is to benefit the students and faculty today while preserving the foundation of the university — and that means thinking about how to benefit the students and faculty of 2050. Our job is to find a balance between spending the right amount today to ensure excellence while also maintaining the benefit for future generations who attend Rice.

What do you say to those who argue that Rice should lower tuition across the board rather than fund more scholarships?

Kathy: Practically speaking, Rice already funds a significant portion of a student’s education. I’ve estimated, based on the fiscal year 2019, that it costs about $70,000 for one year of undergraduate education, leaving aside room and board. It is costly to provide small classes taught by great tenured faculty, to maintain technology and labs, to provide academic advising, student support services and so much more. By comparison, tuition was $48,330 in FY 2019. So, with tuition we are already subsidizing every student even before financial aid. Thanks to Rice’s significant financial aid offerings, the large majority of students pay much less. In fact, our students have less than $15,000 of federal loan debt when they graduate. And by the way, The Rice Investment will likely lower this average because those recipients will not be required to take out loans as part of their financial aid package. This adds to Rice’s reputation, especially since U.S. News rankings now include a variable on debt at graduation.

Allison: We’d like for anyone who can qualify to be able to attend Rice, and we know that it will take a significant effort to sustain affordability and excellence in perpetuity. That’s what The Rice Investment is about, and that’s why we took the big risk to launch The Rice Investment now – shouldering much of the cost up front. Comparatively, we are using more of our endowment to fund scholarships than many of our peers.

How will the economic crisis affect the university’s operating budget?

Kathy: The pace of economic recovery is important because the endowment is such a major source of revenue, some 40% of our total operating budget. While we rely heavily on the distributions from the endowment to support the budget, we also are disciplined on how much we use each year. The university’s endowment spending policy allows Rice to set annual distributions based on a percentage of the trailing three-year average market returns. So, we are not riding a roller coaster. We don’t drastically cut back when markets go down or increase spending when markets return.

Allison: We don’t want students to have to question if their scholarship will be honored. One of the big reasons we can reassure our students and community is endowments. And because endowments grow over time, their impact continues to grow as well.

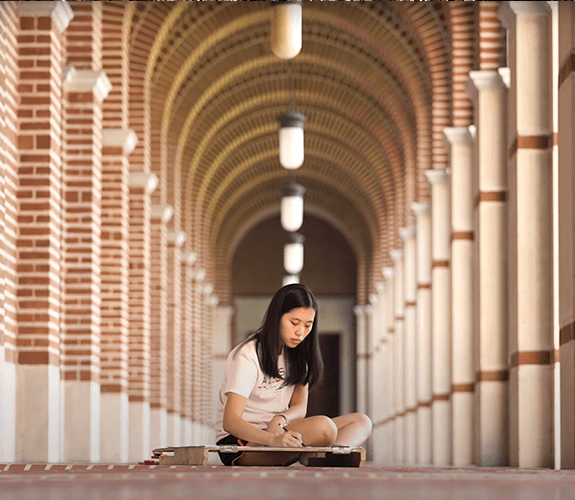

How can we ensure affordability for future generations?

Allison: The key to our success is the generous donors who support scholarships, which are powerful vehicles for establishing a legacy. If you think about scholarships that were created 20, 30 or even 50 years ago — in their first five years, they might have helped a handful of students. But over the lifetime of the endowment, that number increases many times. The Andrews scholarship is a perfect example. The payout in 2020 is even larger than the original gift made in 1969.

Kathy: If you look at the examples of scholarships established decades ago, you see exponential growth that has benefited so many of our students. To create a scholarship endowment is to invest in the strength, diversity and promise of our students and the university. Scholarship endowments help Rice meet its financial aid commitments even as we continue to draw from the endowment to support the operations of the university. We can’t underscore enough how valuable these investments are to Rice and its mission to sustain affordability for future generations.

To learn more about endowments, go to giving.rice.edu/endowments or contact Development and Alumni Relations at stewardship@rice.edu.